To understand how to transform your shared law office into space a cash cow, you have to understand math. Here is a simple outline.

Let’s face it, if the majority of lawyers were great with numbers we’d all be working in finance for Goldman Sachs. For the numerically challenged among us, here’s a crash course in managerial accounting:

Fixed Expenses

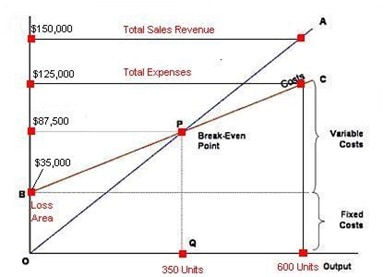

A discussion about fixed expenses is incomplete without discussing “variable expenses”. Variable expenses are those that increase or decrease simultaneously with the increase or decrease of your billable hours. Interestingly, in a law practice most of our variable expenses are passed on to clients, whether billed directly as expense reimbursements or factored into hourly rates. For example, copies, court reporters, filing fees, long distance toll charges, messenger and postage charges are common variable expenses in a law practice. Of course, the biggest variable expense of them all: taxes.

Pure Fixed Expenses

Some fixed expenses are pure expenses. That is, no matter how much you pay for the expense each month, it will never add any value to the practice in terms of increasing revenues. A good example of this type of fixed expense is any kind of insurance, including your malpractice policy.

Profit Center Expenses

Unlike pure fixed expenses, some fixed expense can actually add revenue to the business. These are profit center expenses. Employee salaries, for example, can be considered profit center expenses. In most cases, employee salaries are fixed expenses. However, an employee should either be billing clients, therefore paying for the expense of their own salaries (i.e., associates or paralegals), or be admin staff who take on the burden of the practice’s non-billable work, thereby freeing up attorney time for revenue generating activities such as billing or marketing.

Some fixed expenses can be profit center expenses in some firms, and pure expenses in others. For example, the firm’s copy machine. Many firms mark up the cost of copies and bill clients outright. If you bill and collect enough in copy charges to exceed the cost of the lease, paper and service contract, then your copier (fixed expense)has turned into a profit center (or at the very least covers its own expense).

Why fixed expenses are dangerous to the small firm lawyer in shared law office space:

For small firm lawyers, fixed expenses can mean the difference between a practice that thrives or one that merely survives. If you hang around enough solo or small firm lawyers, you’ll eventually meet a lawyer who has ramped up his or her practice only to become too burdened by fixed expenses. Sadly, these lawyers are frequently forced to scale back their practices or give up on their entrepreneurial dream.

The fiscally savvy small firm attorney will take a hard look at all the fixed expense of his or her practice and determine what expenses can be tweaked to be revenue generators. As discussed above, some fixed expenses, such as insurance, will never generate revenue.

Look carefully, however, and you will be surprised at how many expenses can be converted to revenue centers. The easiest place to start is one of your biggest fixed expenses: office rent.

By choosing the right office for your practice, it’s possible to get your office to generate revenues that will at least pay for your rent, and perhaps a lot more, merely by showing up to your office every day.